We are focused on improving credit availability for users from

tier-2 & tier-3 cities. Currently, lower & mid-income segment groups don't have access to

high-quality financial services, low ticket sizes and being non-focus groups for banks. We believe by

leveraging technology we could build a self-serve system that could deliver a great experience while ensuring we

capture sufficient data points for underwriting credits.

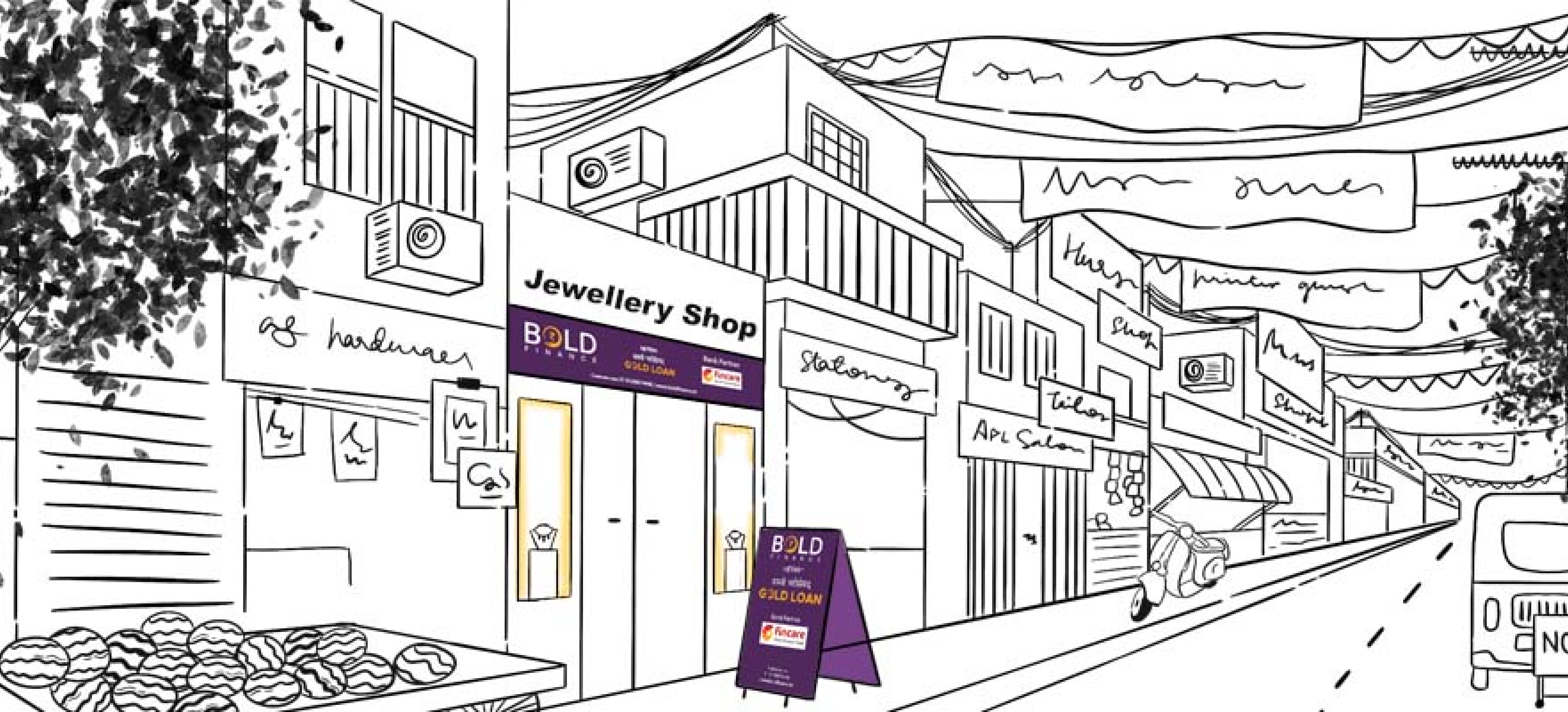

Our first credit product is a Gold Loan.

Currently, 65% of the $130 billion gold loan market is unorganised

(bypassing regulations) & managed by pawnbrokers, money lenders, and jewellers, amongst others. In the

unorganised market, customers are exploited frequently with high-interest rates (>30%).

We are building technology which enables jewelers &

pawnbrokers to work with multiple banks & convert unorganised businesses into organised ones with no hassle.

This will also reduce the interest rates charged to end customers.

.png)